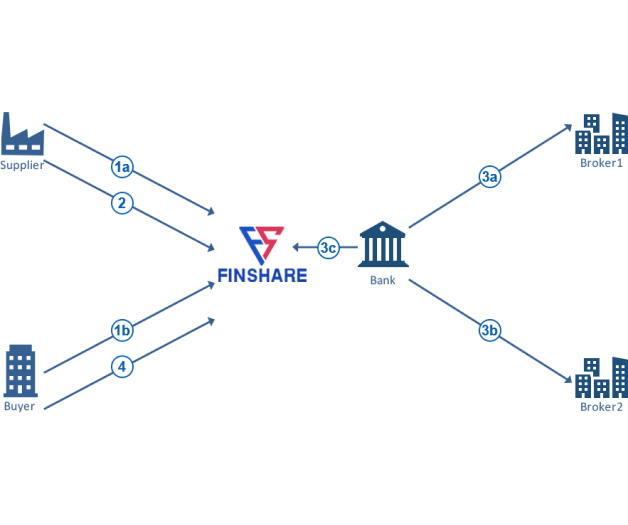

Step1A

Enhanced Invoicing with Buyer Confirmation

In Finshare, supplier invoices with mandatory buyer confirmation streamline payments, enhance transparency, and ensure efficient and reliable invoicing for users.

|

Step1B

Buyer Uploads Confirmed Payables

Finshare's buyer-confirmed payables simplify supplier financing, improving cash flow and stability while streamlining payments for users.

|

Step2

Supplier Requests Discount

FinShare's Supplier request discount feature allows users to negotiate invoice discounts, improving cash flow and financial stability.

|

Step3A

Bank's Commodity Purchase

The bank completes a commodity purchase transaction with Broker 1, ensuring the acquisition of the desired commodity.

|

Step3B

Bank resells the commodity to Broker 2

In a seamless process, the bank successfully procures a specific commodity from Broker 1, fulfilling its acquisition needs.

|

Step3C

Bank advances cashes to Supplier via FinShare

Bank efficiently provides cash advances to suppliers, streamlining the funding process and supporting their financial needs.

|

Step4

Buyer pays at maturity

The buyer settles the payment when it reaches maturity, ensuring timely and agreed-upon transactions.

|

|

|