|

Seller Centric

Islamic Receivable Finance

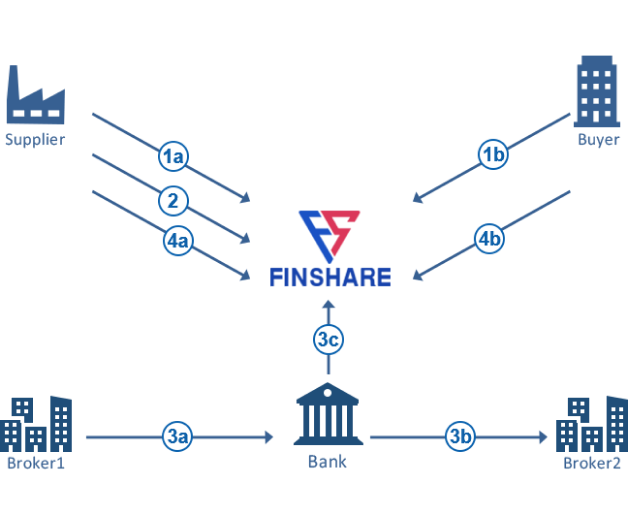

FinShare enables Sharia-compliant Islamic Receivable Finance (IRF) for working capital. Suppliers access financing based on the Cost-Plus Model, using a MURABAHA derivative against receivables.

Commodity transactions, supported by brokers, facilitate the process. Adhering to Sharia principles, IRF offers a solution that ensures compliance with Islamic financial principles.

|

|

|

|

Benefits

How FinShare Uses Islamic Receivable Finance to Benefit You

Learn more below about how FinShare uses Islamic Receivable Finance to benefit businesses and optimize financial health. FinShare's proprietary technology streamlines the Islamic Receivable Finance process, making it faster and more efficient for businesses.

Additionally, FinShare offers personalized support and guidance to ensure that businesses are making the most of their financing options and optimizing their financial health.

|

|

|

|

||||

|

|

||||

|