Syndication

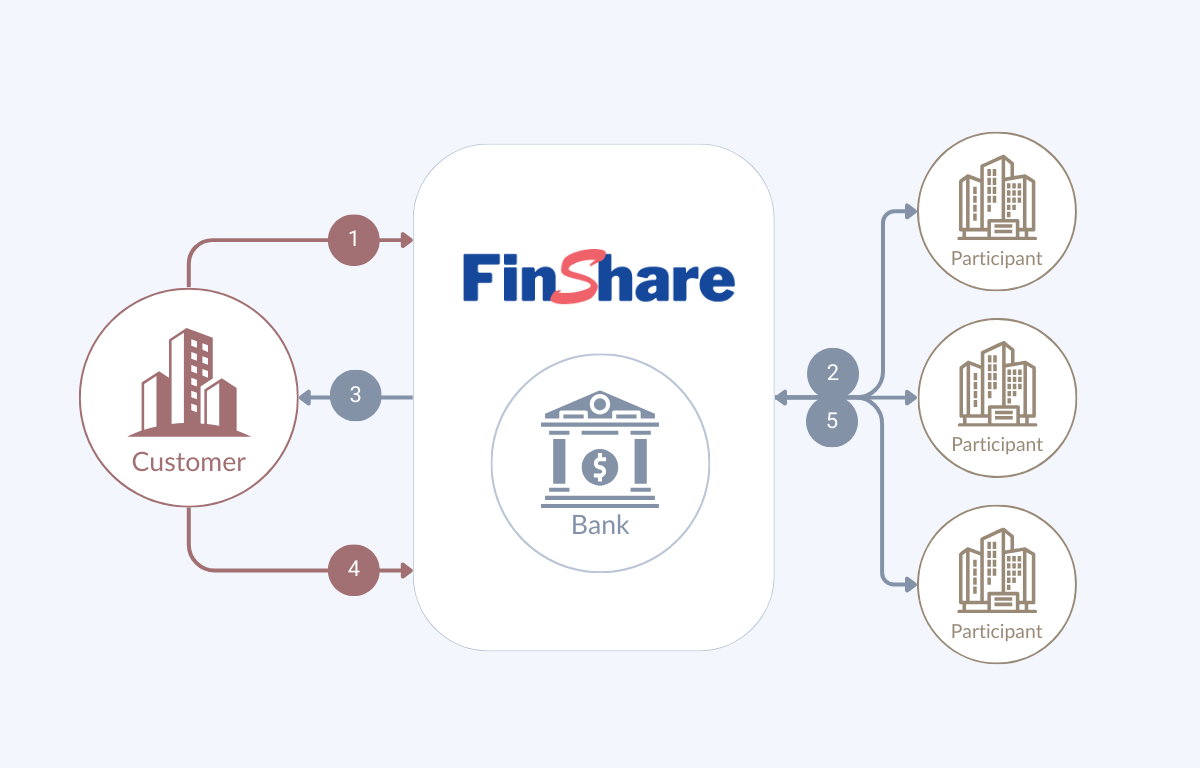

Syndication in FinShare allows banks to manage transactions effectively. The Lead Financial Provider maintains an unchanged relationship with the Customer, while establishing multiple parallel relationships with Participants through the Syndication agreements. This ensures efficient collaboration among all parties involved in the financing process.

Book a Demo

How Syndication Works

1

Customer requests financing from Bank.

2

Bank syndicates and allocates portions of financing to participant/investor.

3

If approved, participant/investor transfers funds to the Bank. Bank processes and disburses financing to Customer.

4

On maturity date, Customer repays loan to the Bank.

5

Bank transfers the fund to participant/investor per syndicated.

How FinShare Uses Syndication to Benefit You

Learn more below about how FinShare uses Syndication to benefit businesses and optimize financial health. FinShare's proprietary technology streamlines the Syndication process, making it faster and more efficient for businesses.

Additionally, FinShare offers personalized support and guidance to ensure that businesses are making the most of their financing options and optimizing their financial health.

Streamlined Automation for Calculations, Reports, and Notifications

FinShare streamlines and automates essential functions such as calculations, reporting, and notifications related to risk participation and syndication. This reduces manual efforts, improves efficiency, and enhances accuracy in the management and monitoring of risk participation activities, enhancing the overall user experience.

Efficient Multiple Risk Participation Relationships

FinShare facilitates the establishment of multiple Risk Participation (RP) relationships for a single loan or financial arrangement with one lead bank. This allows for broader participation and increased diversification of risk, while still maintaining a central point of coordination with the lead bank.

Enhanced Risk-Sharing among Financial Providers

Through FinShare's Risk Participation & Syndication feature, financial providers can establish risk-sharing relationships. This allows for the distribution of risks associated with loans and other financial arrangements, fostering collaboration and enabling participants to mitigate their individual risk exposure.

Support for Funded and Unfunded Participation

FinShare caters to both funded and unfunded participation, providing flexibility to financial providers based on their specific requirements and risk appetite. This versatility allows participants to engage in various levels of financial support, ensuring compatibility with their funding capabilities and overall strategy.

Flexible Loan Coverage Agreements

Financial providers in FinShare have the flexibility to agree on the coverage of all or a part of a loan between the Lead Financial Provider (FP) and the Customer. This customizable approach ensures that risk participation aligns with the preferences and strategies of the participating FPs, accommodating various loan arrangements and risk-sharing preferences.

Ready to optimize your

Supply Chain Solutions

Optimize your supply chain finance offerings with our powerful and intuitive FinShare solution for streamlined operations and enhanced efficiency.

Contact Us