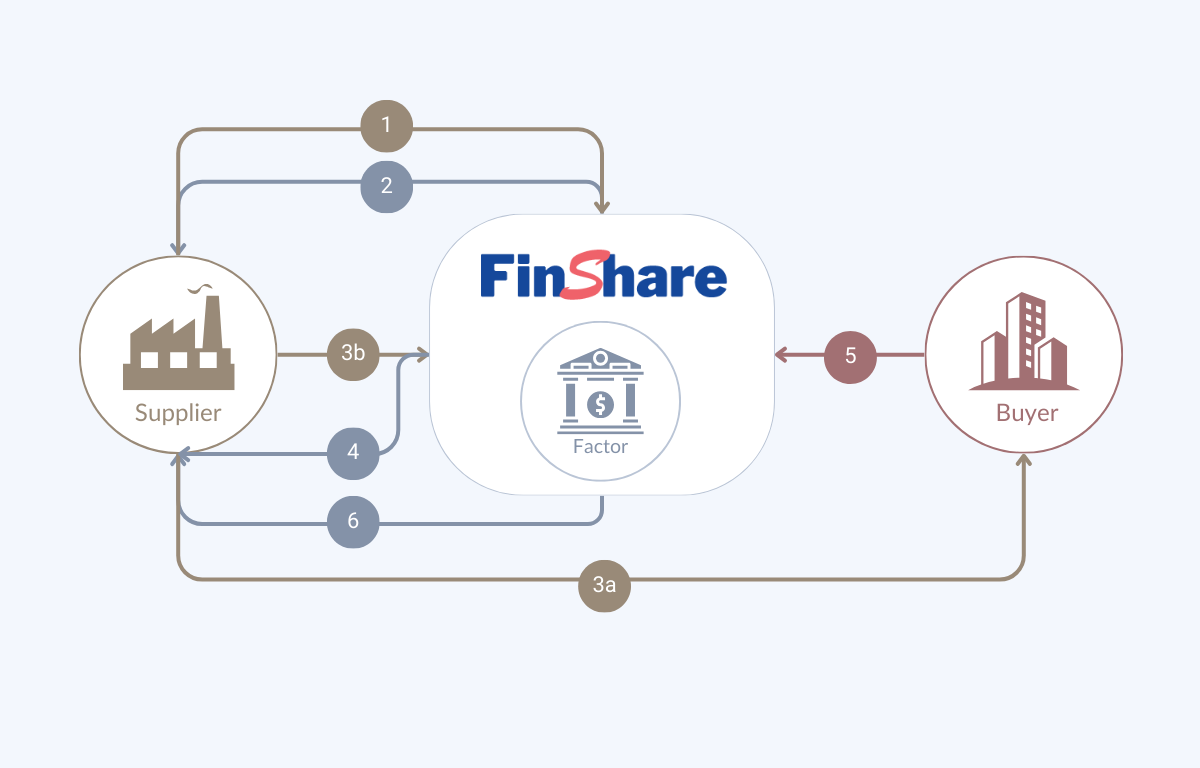

How FinShare Uses Factoring (FCI-Enabled) to Benefit You

Learn more below about how FinShare uses Factoring (FCI-Enabled) to benefit businesses and optimize financial health. FinShare's proprietary technology streamlines the Factoring (FCI-Enabled) process, making it faster and more efficient for businesses.

Additionally, FinShare offers personalized support and guidance to ensure that businesses are making the most of their financing options and optimizing their financial health.

Invoice Factoring Software Features

Our invoice factoring software streamlines operations, simplifies processes, and optimizes efficiency. It offers advanced features such as invoice management, payment tracking, easy uploads, discount calculations, and customizable reporting, providing valuable insights into your factoring activities.

Automated Receivables Valuations

FinShare automates the calculation of the value of outstanding receivables, providing you with up-to-date and accurate information on your financial assets. By automating receivables valuations, you can make informed decisions regarding funding availability, risk assessment, and overall portfolio management.

General Ledger Entries for Double Entry Accounting

Our solutions offer robust general ledger functionality for accurate and reliable double-entry accounting, providing the necessary tools for accurate financial management.

Reserve Rebates and Negative Reserve Rebates

FinShare simplifies the management of reserves by offering features for reserve rebates and negative reserve rebates. You can easily track and calculate rebates based on predefined criteria, ensuring accurate adjustments to your reserve accounts.

Discount Percentages for Transactions

Manage discount percentages efficiently with our invoice factoring software. Set and adjust discounts for early payments or factoring fees based on your needs. Automate calculations to ensure accurate and consistent pricing, enabling transparent and fair transactions. Our software provides flexibility and reliability in managing discount percentages for enhanced pricing control.

Standard, Ad-Hoc, and Custom Reports

Choose from standard pre-built reports, create ad-hoc reports for immediate analysis, or customize reports to meet your specific requirements. Utilize FinShare's reporting capabilities to make data-driven decisions, monitor key performance indicators, and demonstrate transparency to stakeholders effectively.

Purchase Schedules of Invoices

FinShare allows users to create purchase schedules for invoices, providing you with better control over your factoring transactions. You can define the timing and terms of purchasing invoices from clients, aligning them with your cash flow needs and customer preferences.

Effective Risk Management

FinShare provides robust risk management capabilities for supply chain finance, allowing users to assess client creditworthiness, evaluate risks tied to accounts receivable, and make informed financing decisions.

Account Debtor Payments

FinShare provides a centralized platform where users can easily monitor and reconcile incoming payments from account debtors. This streamlines the payment reconciliation process, reduces manual effort, and enhances accuracy in tracking the financial inflows from your clients' debtors.

Automated Advance Upload Capability

FinShare offers an automated advance upload capability, enabling seamless processing and tracking of advances. With this feature, users can efficiently upload and manage advance payments, ensuring timely and accurate disbursement of funds to clients.