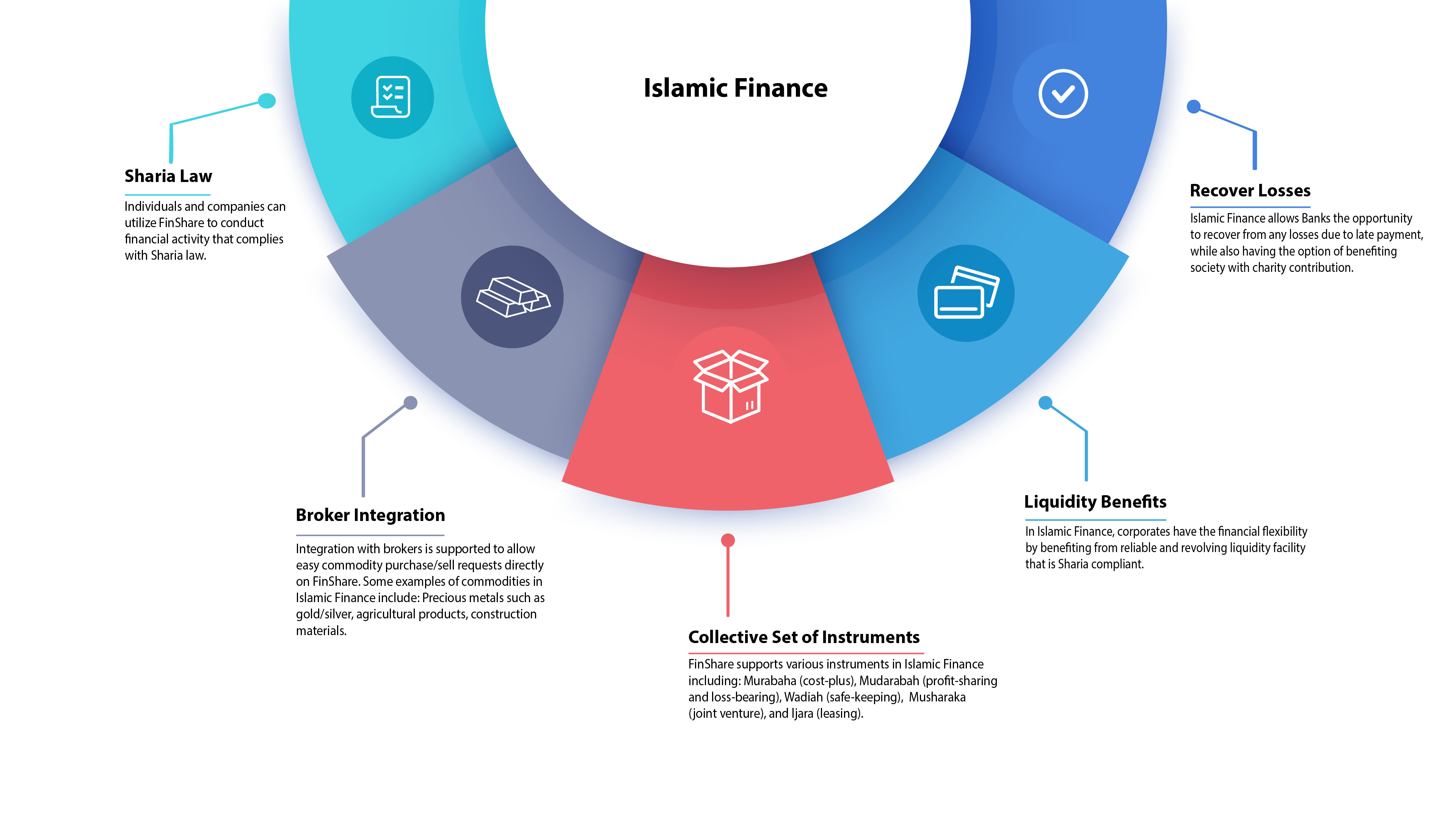

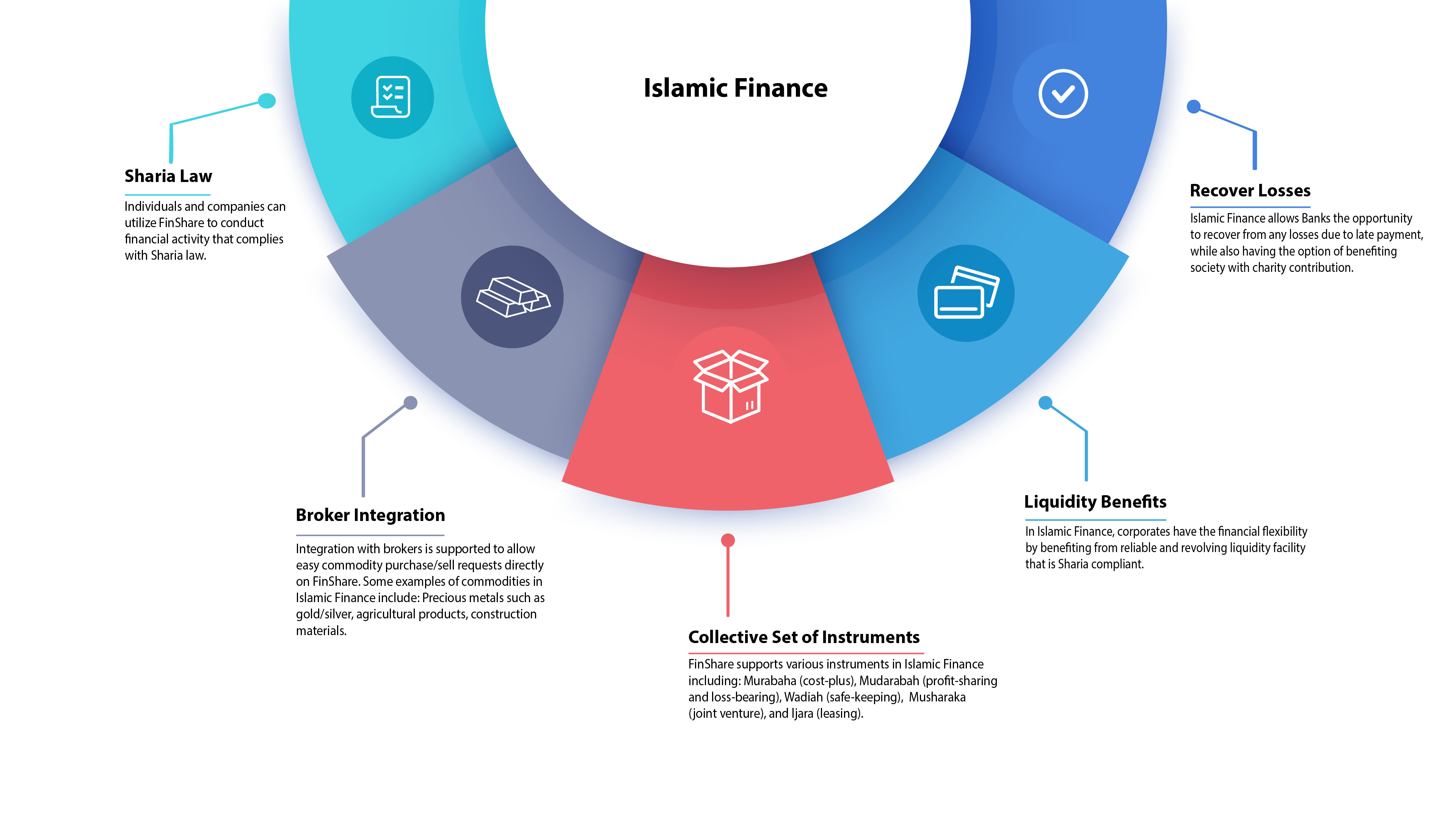

Islamic Finance

Islamic financing, or Sharia-compliant finance, avoids interest and promotes ethical, profit-sharing, and asset-backed financial arrangements in line with Islamic principles, fostering economic fairness and social justice. Individuals and companies can utilize FinShare to conduct financial activity that complies with Sharia law.

Book a Demo

How FinShare Uses Islamic Finance to Benefit You

Learn more below about how FinShare uses Islamic Finance to benefit businesses and optimize financial health. FinShare's proprietary technology streamlines the Islamic Supplier Finance process, making it faster and more efficient for businesses.

Additionally, FinShare offers personalized support and guidance to ensure that businesses are making the most of their financing options and optimizing their financial health.

Efficient Payables Management

Allow corporates to manage their Payables Finance and extend payment terms with regional and international suppliers.

Fair & Transparent Operations

Conduct business in a fair and transparent manner. FinShare will guide users through to ensure full understanding of risks and costs.

Enhanced Trade Facilitation

Facilitate trade and improve payment and financial terms between corporates and their supplier network.

Improved Transparency Assurance

Greater transparency which makes everything clear-cut and easy to understand with little room for surprise payments or hidden fees.

Boosting the Economy with Genuine Trade Activities

Contributes to financial transactions backed by genuine trade or business-related activities that boost the economy governed by Islamic principles.

Recovering Lost Revenue and Contributing to Society

Provides the bank with an opportunity to recover losses from late payments while simultaneously benefiting society through charitable contributions.

Financial Flexibility for Corporates through Reliable Liquidity

Provides corporates with financial flexibility by benefiting from a reliable and revolving liquidity facility.

Transparent Financial Terms in Islamic Receivable Finance

Greater transparency which makes everything clear-cut and easy to understand with little room for surprise payments or hidden fees.

Immediate Cash Access for Suppliers with Account Receivables Sales

Provides Suppliers with immediate access to cash by selling their account receivables offered at reasonable discounts.

Ready to optimize your

Supply Chain and Trade Finance Solutions

Optimize your supply chain and trade finance offerings with our powerful and intuitive FinShare solution for streamlined operations and enhanced efficiency.

Contact Us