Forfaiting

Forfaiting in FinShare allows exporters to obtain cash by selling their medium and long-term receivables at a discount on a non-recourse basis with sole responsibility in manufacturing and goods/services delivery.

Book a Demo

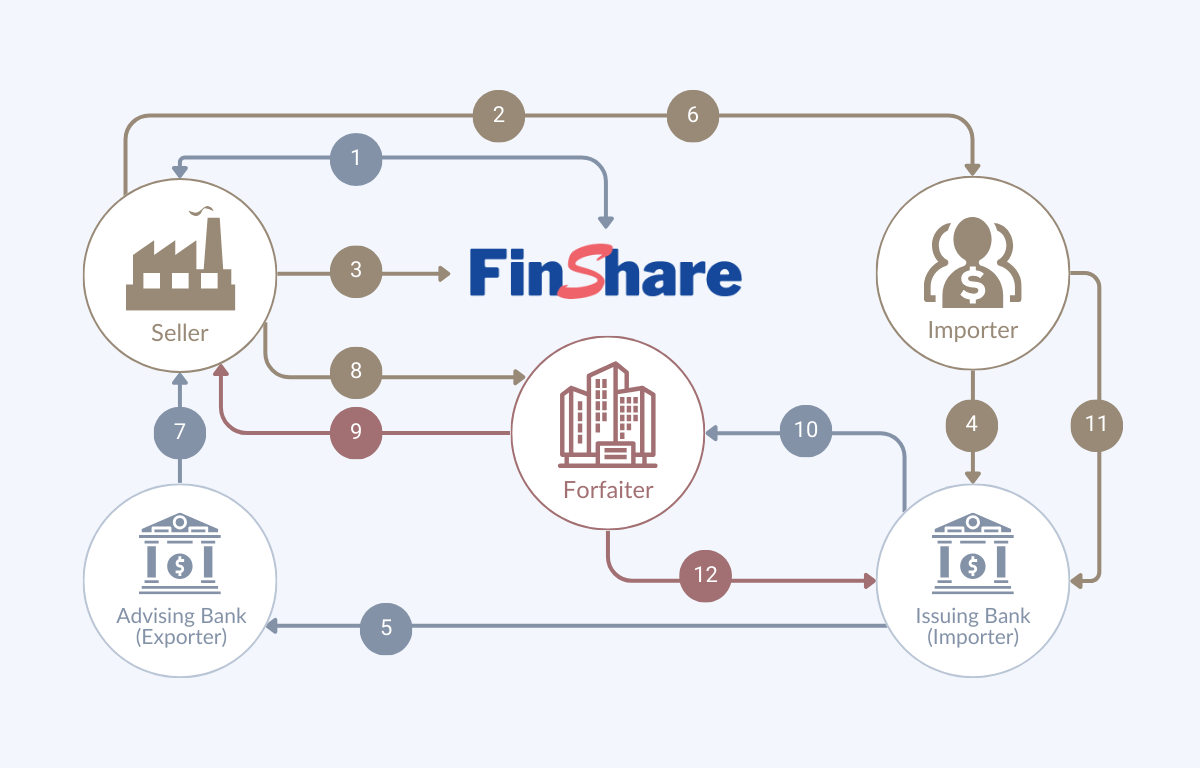

How Forfaiting Works

1

Assess finance feasibility and estimate costs for transactions.

2

Negotiate sales contracts with clear terms efficiently.

3

Streamline forfaiting contract commitments.

4

Deposit promissory notes or request LCs for forfaiting.

5

Forward notes with guarantees or advise LCs seamlessly.

6

Manage delivery of goods/services and track progress.

7

Release notes with guarantees for compliance.

8

Simplify presentation of shipment documents.

9

Disburse discounted proceeds promptly.

10

Claim payment by forwarding debt instrument.

11

Debit importer's account for payment processing.

12

Execute payments on maturity date.

How FinShare Uses Forfaiting to Benefit You

Learn more below about how FinShare uses Forfaiting to benefit businesses and optimize financial health. FinShare's proprietary technology streamlines the Forfaiting process, making it faster and more efficient for businesses.

Additionally, FinShare offers personalized support and guidance to ensure that businesses are making the most of their financing options and optimizing their financial health.

Fixed-Rate Credit and Currency Risk Elimination

Forfaiting provides credit at a fixed rate of interest, and it is possible, therefore, to exchange currency forward as soon as the commercial contract is signed for a definite amount to eliminate currency risk.

Importer Flexibility with Convertible Currency Choice

The importer has a choice of any convertible currency regardless of its home currency.

Streamlined Handling of Multi-Sourced Goods

Multi-sourced goods can be handled in one contract, relieving the importer of restrictions imposed by different government credit insurance agencies.

Ready to optimize your

Supply Chain Solutions

Optimize your supply chain finance offerings with our powerful and intuitive FinShare solution for streamlined operations and enhanced efficiency.

Contact Us