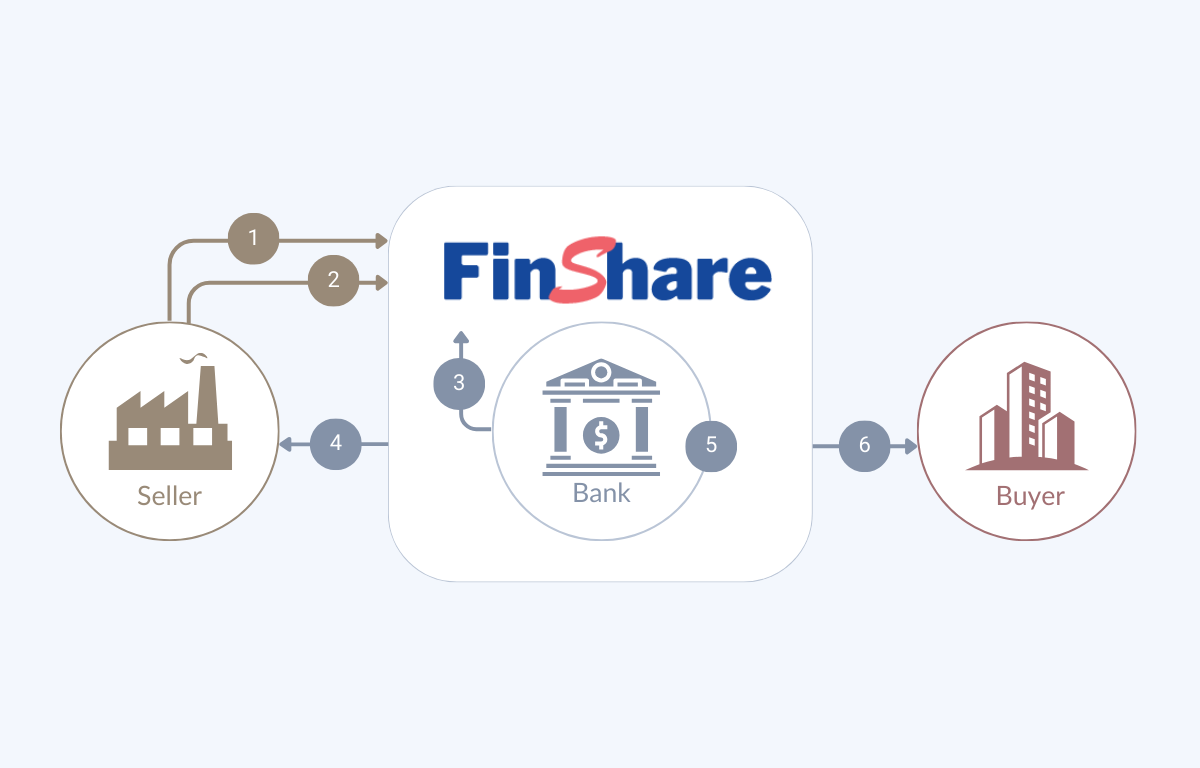

How FinShare Uses Account Receivables Finance to Benefit You

Learn more below about how FinShare uses Account Receivables Finance to benefit businesses and optimize financial health. FinShare's proprietary technology streamlines the Account Receivables Finance process, making it faster and more efficient for businesses.

Additionally, FinShare offers personalized support and guidance to ensure that businesses are making the most of their financing options and optimizing their financial health.

Shorten Cash Conversion Cycle

FinShare's powerful financial management tools can help shorten your business' cash conversion cycle by streamlining payment processes, optimizing cash flow management, and providing quick access to financing options.

Community for Recourse vs Non Recourse Financing

Better manage risk by choosing the financing option that best aligns with your financial goals and risk tolerance. With non-recourse financing, the risk is on the buyer, while with recourse financing, the risk is on the seller. This knowledge can help you make more informed financing decisions.

Receivable Finance Solutions for Various Business Needs

With our Receivable Finance solution, you can facilitate Distributor Finance, Dealer Finance, Vendor Finance, and Trade Receivable Purchase.

Boost Efficiency and Productivity

With automated workflow, enable businesses to automate eligible invoices into the trade asset and discounting process. Enhance overall experience with minimal manual tasks and streamline processes.

Straight-Through Processing

Benefit from straight-through processing, which automates the entire financing process from invoice verification to payment processing, providing a faster and more efficient financing solution.

Robust Reporting Available to Bank, Supplier, and Buyer

FinShare Account Receivables Finance offers robust reporting capabilities to banks, suppliers, and buyers, providing valuable insights into cash flow management, creditworthiness, and overall financial health.

Auto-Discounting with Asset Picking

Asset Picking in FinShare Account Receivables Finance enables businesses to automate the selection and discounting of eligible invoices for financing, improving cash flow management and financial health.