Approved Payables Finance

FinShare allows buyer to submit approved invoice for payment on the platform, triggering an alert to the supplier, empowering them to choose between manual selection or automatic financing for discounting.

This seamless process, known as Straight-Through Processing (STP), ensures a smooth flow from approved invoices to payment, streamlining the entire transaction cycle.

Book a Demo

How Approved Payables Finance Works

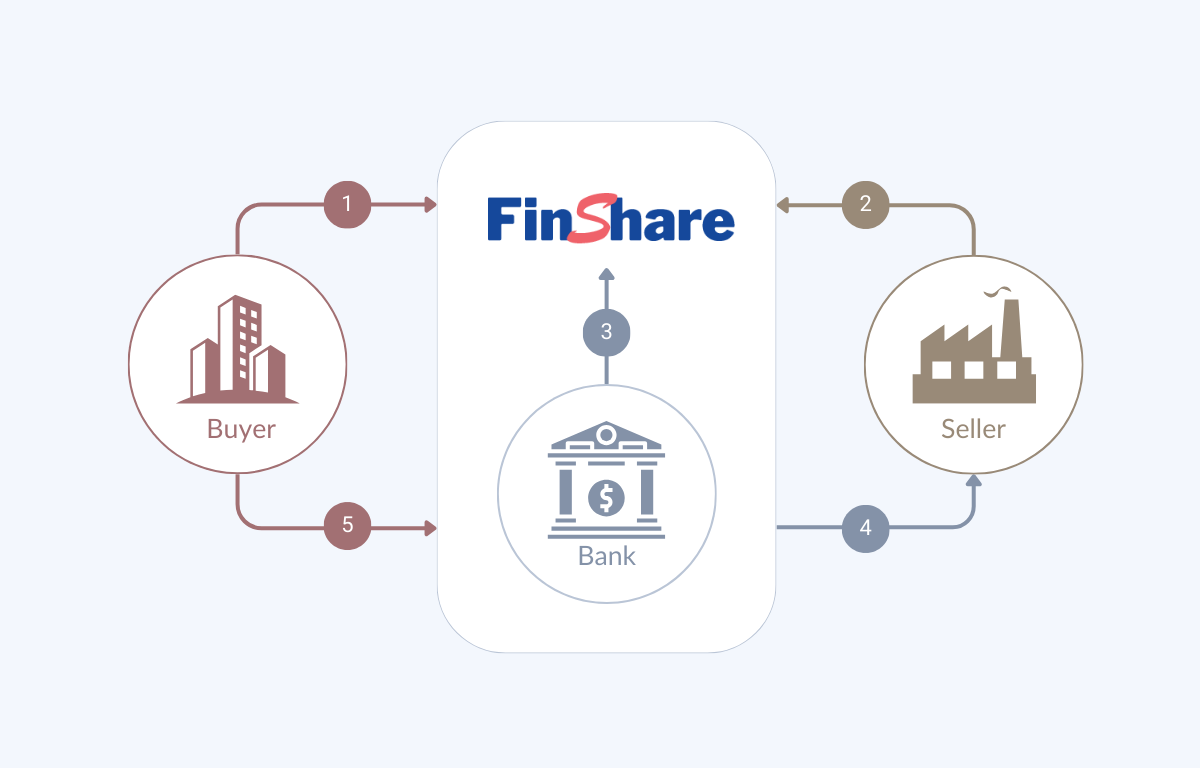

1

Buyer uploads invoices for processing and financing through the system.

2

Supplier choose invoice to be discounted, indicating their intention to leverage the invoices for working capital.

3

Bank processes the finance request (discounted invoices) using FinShare, ensuring accuracy and efficiency throughout the process.

4

Bank provides required working capital to Seller if the chosen invoices meet financing criteria.

5

Bank ensures timely settlement for the Buyer as the assigned payable invoices reach their maturity date.

How FinShare Uses Approved Payables Finance to Benefit You

Learn more below about how FinShare uses Approved Payables Finance to benefit businesses and optimize financial health. FinShare's proprietary technology streamlines the APF process, making it faster and more efficient for businesses.

Additionally, FinShare offers personalized support and guidance to ensure that businesses are making the most of their financing options and optimizing their financial health.

Streamlined Transaction and Relationship Management

Buyer-supplier relationship management and STP ensures smoothly workflow from approved invoice to payment.

Automated Invoice Rejection with Lender Filters

Lender driven filters automatically reject invoices that don’t meet eligibility rules (i.e. amount, age, tenor, etc.).

Enhanced Access Control for Buyers and Suppliers

Buyers, as well as their suppliers, may be given direct controlled access to the application.

Flexible Assessment of Interest and Fees

Interest and fees can be assessed on the product level, buyer level, and buyer-supplier levels. They can be tiered, fixed, variable or indexed.

Seamless Invoice Upload Integration

A buyer may either manually upload approved invoice information via XML and CSV, or automatically via a direct link to the buyer’s ERP system (EDI820).

Ready to optimize your

Supply Chain Solutions

Optimize your supply chain finance offerings with our powerful and intuitive FinShare solution for streamlined operations and enhanced efficiency.

Contact Us