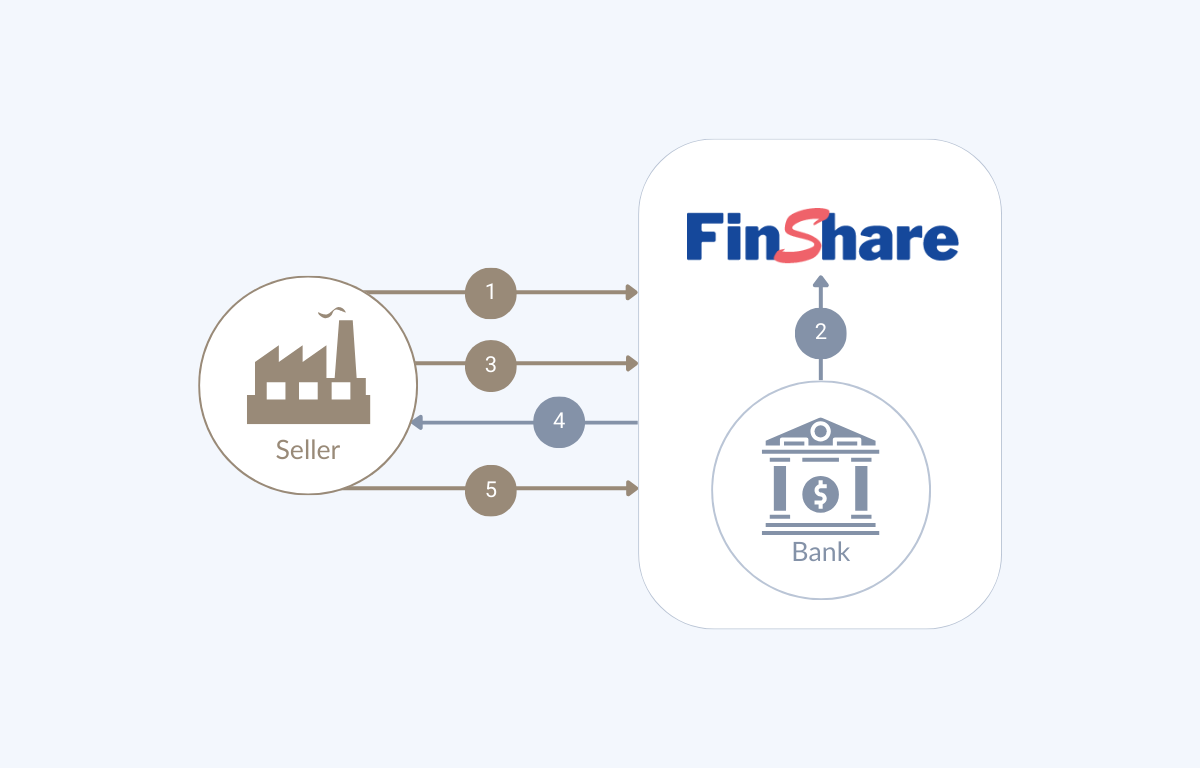

How FinShare Uses Account Based Lending to Benefit You

Learn more below about how FinShare uses Asset Based Lending to benefit businesses and optimize financial health. FinShare's proprietary technology streamlines the Asset Based Lending process, making it faster and more efficient for businesses.

Additionally, FinShare offers personalized support and guidance to ensure that businesses are making the most of their financing options and optimizing their financial health.

Detailed Asset Acceptance Report for Streamlined Decision-making

A report listing accepted and rejected assets brings transparency to Asset Based Lending (ABL) users. It helps identify obstacles like duplicate invoices, bad buyer credit, or compliance issues. This empowers users to optimize their asset portfolio and improve financing prospects in ABL.

Online and Real-Time Reporting and Amendments

Asset Based Lending (ABL) offers users online reporting and real-time amendments. Through FinShare, users can access reports, monitor financial performance, track collateral valuations, and make prompt adjustments to their ABL facilities.

Efficient Setup and Agreement Process

Asset Based Lending (ABL) simplifies setup by generating a "Borrowing Base Certificate" and essential documents for establishing a customer relationship. The certificate serves as the client's agreement for the credit facility or updates based on asset valuation. ABL's efficient documentation saves time and effort, allowing users to focus on leveraging assets and accessing funding for business needs.

Comprehensive Item-Level Tracking and Payment Management in ABL

With FinShare, users in asset-based lending (ABL) can efficiently track all items, including payments at a granular level. This level of tracking provides enhanced visibility and control over their assets, allowing for accurate cash flow management.

Streamlined Asset Management and Faster Financing Process

Asset Based Lending (ABL) offers the notable benefit of automated uploading of borrower's assets. This automated process simplifies and expedites asset management for users. By seamlessly uploading their assets, borrowers can efficiently provide the necessary collateral information to the lender. This automation not only saves time but also ensures accuracy and consistency in asset reporting.

Streamlined Communication and Enhanced Customer Service

FinShare revolutionizes Asset Based Lending (ABL) by offering a centralized customer communication system. With FinShare, users can track all communication in one place, ensuring efficient collaboration, transparency, and consistent information exchange.

Improved Transparency and Monitoring

Asset Based Lending (ABL) provides customers with an online view for real-time insight into their financing journey. By accessing the portal, customers can track application status, monitor approval progress, and stay informed about collateral valuation. This increased visibility empowers informed decision-making, proactive response to updates, and effective cash flow management.